Fine Art for Wealth Preservation – artmarketblog.com

Due to popular demand, I have posted the entire ‘What Art Investors Can Learn from Gold Investors’ series from start to finish, and have also added a further conclusion. I also changed the title to better reflect the subject matter. Hope you enjoy !!!!

What Art Investors Can Learn from Gold Investors Pt. 1 – artmarketblog.com

If am sure that everyone who is reading this post will be aware that the price of gold has increased significantly in recent times, and is poised to increase even more over the coming months. The long bull run that gold has been able to sustain has made the gold market one of the most watched and analysed markets on the planet, and has given people even more reason to consider acquiring a physical position in gold. As an art market analyst and art investment expert I try and keep an eye on as many different investment markets as I can in an effort to acquire knowledge and skills that I can apply to the art market. Although the art market is a unique market that appears to have very little in common with other investment markets, I often come across small yet very important similarities when comparing the art market to other markets that usually turn out to be very useful. In fact, even analysing small differences between the art market and other markets can prove to be beneficial when assessing the art market as a whole or when assessing a particular sector/event. For this reason I always find it interesting and useful to make comparisons between what is happening in the art market and what is happening with other investment markets.

If am sure that everyone who is reading this post will be aware that the price of gold has increased significantly in recent times, and is poised to increase even more over the coming months. The long bull run that gold has been able to sustain has made the gold market one of the most watched and analysed markets on the planet, and has given people even more reason to consider acquiring a physical position in gold. As an art market analyst and art investment expert I try and keep an eye on as many different investment markets as I can in an effort to acquire knowledge and skills that I can apply to the art market. Although the art market is a unique market that appears to have very little in common with other investment markets, I often come across small yet very important similarities when comparing the art market to other markets that usually turn out to be very useful. In fact, even analysing small differences between the art market and other markets can prove to be beneficial when assessing the art market as a whole or when assessing a particular sector/event. For this reason I always find it interesting and useful to make comparisons between what is happening in the art market and what is happening with other investment markets.

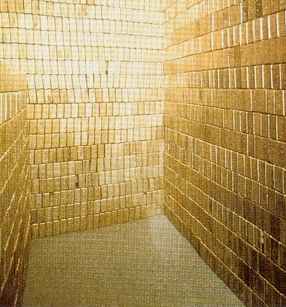

One investment market that I have paid particularly close attention to recently is the gold market. I am not only keeping an eye on the gold market because of the progress it is making, but also because one can learn a lot about the art market and art investment from what many people consider to be the ultimate safe haven investment. Gold has been used as a store of value/wealth and a form of currency for thousands of years, and continues to remain the ultimate universal representation of wealth and value. To understand what the gold market has to teach us about the art market and art investment one must first know a few important things about gold and the gold market. One of the most significant reasons that gold is such a highly prized metal is that is a very rare and finite resource. In fact, it is estimated that if all the gold that has been mined on earth to date were put together, it would not quite even fill a 20mx20m cube. Add to this the fact that the amount of gold mined every year would only add 12cm to this cube and one can see exactly how rare gold is. Not only is gold rare, but it also has particular physical properties that make it even more desirable and more suitable as an investment. It is partly because gold does not corrode, rust or tarnish, and cannot be counterfeited, that it is such a suitable store of value and such a popular investment. By purchasing physical positions in gold one can feel pretty confident in the knowledge that it is extremely unlikely that their gold will ever be destroyed.

An article in the National Geographic magazine from January 2009 said that: “Gold is not vital to human existence; it has, in fact, relatively few practical uses. Yet its chief virtues—its unusual density and malleability along with its imperishable shine—have made it one of the world’s most coveted commodities, a transcendent symbol of beauty, wealth, and immortality.” Although the physical properties and rarity of gold contribute significantly to the value bestowed upon the precious metal, there is one other extremely important characteristic of gold that makes it so attractive and that characteristic is beauty. As the National Geographic article says, gold has an imperishable shine as well as a lovely lustre and beautiful gold glow that seems to make most human beings weak at the knees. The website gold.org sums up the attractiveness has this to say about the attractiveness of gold: “Since the beginning of time, the intrinsic beauty, warmth, sensuality and spiritual richness of gold has earned it pride of place as the favourite metal of jewellers. Gold has inspired craftsmen to create objects of desire that unite us with our emotions. In the Middle Ages, alchemists attempted to use their magic to make gold from other metals. They believed that gold was a source of immortality, and so it was used in medicines designed to fight old age and prolong life.”

What does all this have to do with art I hear you ask? Stay tuned for part 2 !!!

What Art Investors can Learn from Gold Investors Part 2 – artmarketblog.com

All one has to do is look at the jewellery people are wearing to realise that gold is considered by most people to be a substance of great beauty. Since gold has very few uses other than as a material for making jewellery and other precious objects, were gold not physically attractive, it would not be anywhere near as desirable as it is. It is because so many people find gold desirable and attractive that there is such high demand for gold. If only a small percentage of the population were to find gold attractive and desirable then demand would be much lower. However, it is not just the fact that gold is physically attractive to human beings that makes it an excellent investment and a highly valuable substance. As I have shown, the desirability of gold can be linked to three main factors: physical beauty, mass appeal and rarity. Without any one of these three factors, gold would not be anywhere near as valuable as it is, so it is these three factors that I want to explore in relation to art investment.

All one has to do is look at the jewellery people are wearing to realise that gold is considered by most people to be a substance of great beauty. Since gold has very few uses other than as a material for making jewellery and other precious objects, were gold not physically attractive, it would not be anywhere near as desirable as it is. It is because so many people find gold desirable and attractive that there is such high demand for gold. If only a small percentage of the population were to find gold attractive and desirable then demand would be much lower. However, it is not just the fact that gold is physically attractive to human beings that makes it an excellent investment and a highly valuable substance. As I have shown, the desirability of gold can be linked to three main factors: physical beauty, mass appeal and rarity. Without any one of these three factors, gold would not be anywhere near as valuable as it is, so it is these three factors that I want to explore in relation to art investment.

Gold is a finite resource which means that only a limited amount of gold exists on the earth. At some stage in the future all the gold that remains in the earth’s crust will be extracted by mining companies and that will be that. Gold cannot be artificially produced so only a certain amount of gold will ever exist. When it comes to fine art, rarity is a factor that comes into play on a regular basis, and is extremely important to consider when approaching art as an investment. Original works of art are pretty much always one offs and therefore rare in their own right, so it is important for art investors to look at the bigger picture. Let me explain. Just like gold, the work of a deceased artist is finite resource, whereas a contemporary artist who is still alive could go on to produce any number of subsequent works of art. A good example of an artist with a small oeuvre is Vermeer whose oeuvre consists of an extremely small number of works; thirty seven paintings are known to have been definitely painted by Vermeer with a further 13 or so attributed to his hand. Because there are so few works by Vermeer in existence there is huge demand for his work which usually sells for tens of millions of dollars. Rarity can also apply to the number of works on the market as opposed to just the number of works an artist produced. The work of artists whose work is in high demand from public museums and galleries will often fetch higher prices when their works to come on the market because so many of their works are owned by galleries and museums, which leaves less works for private collectors and investors to purchase.

Art investors who want a safer long term investment as a hedge against more speculative investments should therefore be purchasing the work of deceased artists who produced as small a body of work as possible. When it comes to art investment I firmly believe that art investment should not be a short term speculative investment, as some people believe it should, and should only be approached as a long term hedge against speculative investment markets such as the share market.

Stay tuned for part 3………

What Art Investors can Learn from Gold Investors Pt. 3

In my last post I began to make comparisons between the gold market and the art market from an investment perspective. Today I want to begin winding up this series of posts by looking at one of the most important, but also one of the most controversial qualities, which is common to both art and gold, and which is crucial to both the gold and art market. And that quality is beauty. Gold undoubtedly has an intrinsic beauty, and hence an intrinsic value, that makes it attractive to a large number of people. Just take a look at how many people wear gold jewellery and you will get an idea of how popular gold really is. The World Gold Council summarises the allure of gold quite nicely with the following statement:

In my last post I began to make comparisons between the gold market and the art market from an investment perspective. Today I want to begin winding up this series of posts by looking at one of the most important, but also one of the most controversial qualities, which is common to both art and gold, and which is crucial to both the gold and art market. And that quality is beauty. Gold undoubtedly has an intrinsic beauty, and hence an intrinsic value, that makes it attractive to a large number of people. Just take a look at how many people wear gold jewellery and you will get an idea of how popular gold really is. The World Gold Council summarises the allure of gold quite nicely with the following statement:

“Since the beginning of time, the intrinsic beauty, warmth, sensuality and spiritual richness of gold has earned it pride of place as the favourite metal of jewellers. Gold has inspired craftsmen to create objects of desire that unite us with our emotions. In the Middle Ages, alchemists attempted to use their magic to make gold from other metals. They believed that gold was a source of immortality, and so it was used in medicines designed to fight old age and prolong life.”

With art, however, the debate continues to rage as whether or not art actually does have intrinsic value. I think that it is time for me to settle this debate once and for all. Some art does have intrinsic value and some art doesn’t. Let me explain. Many people struggle to define beauty when it comes to art, but I don’t find it that difficult. As art is a visual medium it would make sense that beauty, in relation to visual art, must therefore involve the art object it’s self. What else would it involve, I hear you ask. Well, a lot of art these days involves much more than the visual component of art (ie. the art object). Take conceptual art for instance. Conceptual art may not even involve a visual component at all; the art object is usually replaced by a concept. You may have noticed that contemporary art often involves a component other than the art object, even if the work is not conceptual, and even if there is an art object. If you go to any contemporary art gallery or museum, you are likely to find that many of the works are accompanied by lengthy explanations that on needs to read to fully appreciate and understand the visual component of the work. Combine this fact with the fact that many modern and contemporary art objects would NOT be considered beautiful by most people (if by anyone at all) and one begins to understand that visual art is no longer about beauty, or the art object for that matter. The purpose of art underwent a fundamental change with the onset of the modern era. Social, political, philosophical and cultural issues infiltrated the art world to an extent that had never been witnessed before. When it came to priorities, beauty began to take a back seat during what was essentially a second renaissance that saw the role of the artist change from that of an artisan to something more akin to a cross between an avant-gardist, an activist, a revolutionary and an entertainer. Professor Terry Eagleton famously said that `to the avant-garde truth is a lie, morality stinks and beauty is shit’. The task of art, he believes, `is to be a hammer, not a mirror…Art’s job is to unleash contradictions . . . to shatter and wound.’

Eleni Gemtou of the University of Athens summed up the situation relating to beauty and art perfectly in her paper “The Role of Beauty in Art and Science’ in which she said: ‘Many are the works of art that have been created in order to satisfy philosophical and intellectual concerns, to provoke, to alert or even to serve social, religious and political objectives. In these cases, beauty and aesthetic satisfaction are either coincidental or completely absent.’ Gemtou then goes on to say ‘In the first half of the 20th century, art disengaged from its role to represent reality and to express beauty. Artists and movements expressing various world-perceptions, such as Fauvism, Expressionism, Cubism, Futurism etc. abolished traditional styles and introduced the principles of two – dimensionality, deformity, splitting and the projection of the process on the completed work. Form functioned as a revolutionary vehicle, while the subject in many works of art acquired a secondary and even a non-existent role (abstraction)’ (THE ROLE OF BEAUTY IN ART AND SCIENCE by Eleni Gemtou)

To be continued………

What Art Investors Can Learn from Gold Investors Pt. 4 – artmarketblog.com

The definition of an investment, in financial terms, is basically the purchase of a financial product or other item of value with an expectation of favorable future returns. In general terms, investment means the use money in the hope of making more money (definition from investorwords.com). Although gold is often referred to as an investment, it really is not a good investment, especially over the long term. James Turk, founder and chairman of GoldMoney as well as co-author of the investment bestseller ‘The Collapse of the Dollar’, says that “Gold is not an investment. It is money. Gold doesn’t generate a rate of return like investments do. The price of gold is rising against all the world’s currencies because currencies are losing purchasing power, while gold is preserving purchasing power”. Instead of calling this article ‘What Art Investors can Learn from Gold Investors’, I should probably have called it ‘What People who use Art for Wealth Preservation can Learn from People who use Gold for Wealth Preservation’. However, if I had used the more correct title I do not think as many people would have read this series of posts.

The definition of an investment, in financial terms, is basically the purchase of a financial product or other item of value with an expectation of favorable future returns. In general terms, investment means the use money in the hope of making more money (definition from investorwords.com). Although gold is often referred to as an investment, it really is not a good investment, especially over the long term. James Turk, founder and chairman of GoldMoney as well as co-author of the investment bestseller ‘The Collapse of the Dollar’, says that “Gold is not an investment. It is money. Gold doesn’t generate a rate of return like investments do. The price of gold is rising against all the world’s currencies because currencies are losing purchasing power, while gold is preserving purchasing power”. Instead of calling this article ‘What Art Investors can Learn from Gold Investors’, I should probably have called it ‘What People who use Art for Wealth Preservation can Learn from People who use Gold for Wealth Preservation’. However, if I had used the more correct title I do not think as many people would have read this series of posts.

The sort of investment I am writing about is an investment in one’s future financial security; an investment in wealth preservation, not wealth creation. I am not suggesting that art is as good a substitute for paper money (currency) as gold is. You may, however, be surprised to learn that fine art IS actually used as a form of currency in the criminal underworld. Stolen paintings are often used as collateral for drug or weapons deals which means that there is a black market for works of art which, interestingly, value works of art at as little as one tenth of their auction price (a great topic for a future post !!!). For a work of art to have value as a form of currency there are certain characteristics that the work of art needs to have. It would make sense that the more people who find a stolen work of art desirable, the more valuable the work of art would be on the black market. The most universally appealing and desirable characteristic that a work of art can have is the sort of instantly gratifying beauty that characterised the work of the old masters, and also the work of the more modern movements such as Romanticism, Realism and Impressionism where beauty and aesthetic satisfaction were still prime motivators. Essentially what I am referring to is the traditional and transcendental definition of beauty that aims to induce pleasure through physical attractiveness. An article that appeared in Forbes magazine in 2001 titled “Old Masters Soothe New Troubles” (by Anna Rohleder) described why the work of the old masters is so widely admired and universally accessible with the following statement: “At times like this, it isn’t fair to tax viewers with the opaqueness or abstraction of more modern works. Old Masters are accessible, their attractions obvious and their effects immediate. Old Masters convey a “feeling of peace and tranquility, a sense of timelessness that we are all searching for in our frantic lives,” says Arthur K. Wheelock Jr., curator of northern Baroque painting at the National Gallery of Art. “Great art makes you see the world differently.”

As you already know, wealth preservation is about protecting the wealth you already have. In the short term, wealth preservation is about maintaining a hedge against investments you have in more volatile markets such as the stock market. In the long term, wealth preservation is about maintaining some sort of protection from potentially devastating and crippling events such as a major financial crisis. It is long term wealth preservation that I am most interested in as it is the most relevant to the art investor. Legendary author and financial advisor Howard Ruff, in an article he wrote titled ‘Gold and Silver Insurance’, explained one of the reasons that gold is such a good long term wealth preservation vehicle. According to Ruff: “It’s there (gold) to use as real money in the case of a worst-case, like an inflationary currency collapse, or terrorist hackers shutting down the power grid so no one has access to their dollars at the bank or at the ATM and they can’t open the supermarket cash registers. It’s in case the same terrorist-financed hackers break into the computers of the money-center banks where most of the world’s dollars are there in hyperspace, insert a destructive virus and the world’s dollars disappearing in a nano-second.

Remember, only about 5% of the worlds’ dollars are minted, printed or coined. The rest are only on the computers of banks. If the computer data is wiped out, there could go the monetary system of the world, because the dollar is the world’s reserve currency. This would mean the instant collapse of the American economy, and maybe Western Civilization. Then the world would instinctively go back to gold and silver as a means of exchange and store of value until the computers are fixed and a new paper-money system is cobbled together.”

To be continued………….

What Art Investors Can Learn from Gold Investors Pt. 5 – artmarketblog.com

The reason that I finished my last post with a description of a possible economic and financial doomsday like scenario is because such an event would really expose how secure and how safe the various different methods of wealth creation and wealth preservation are. A large majority of the vehicles of wealth creation that we choose to invest our money are dependent on the continued stability of the cultural, social, monetary and economic systems that are currently in place (ie. share market, money market, bond market, currency market etc.). One of the most vulnerable stores of wealth that pretty much everyone has positions in is fiat currency, better known as money. The definition of a fiat currency is: state-issued money which is neither legally convertible to any other thing, nor fixed in value in terms of any objective standard. These days most national currencies are fiat currencies including the US dollar, the Euro and the UK Pound, which makes the currency of most countries very vulnerable. Not only would a currency collapse have a devastating effect on the price of goods, it would also cause any positions in an investment vehicle that is only redeemable in a fiat currency, and is not a tradeable commodity (ie. stock market, bond market etc.), to essentially become as valueless as the currency that the investment relies on. The 0nly way to protect one’s self from total devastation in the event of a currency collapse is to have physical positions in a tradeable commodity such as gold. Gold is an asset with inherent value that is also a tradeable commodity. According to an article in Time magazine: “Gold, then, can be considered a currency, unique in that it is not directly tied to any country’s economy. With a global recession that is bound to continue to shake up the purchasing power of all foreign currencies, gold is safer from political and economic instability than cash.”

The reason that I finished my last post with a description of a possible economic and financial doomsday like scenario is because such an event would really expose how secure and how safe the various different methods of wealth creation and wealth preservation are. A large majority of the vehicles of wealth creation that we choose to invest our money are dependent on the continued stability of the cultural, social, monetary and economic systems that are currently in place (ie. share market, money market, bond market, currency market etc.). One of the most vulnerable stores of wealth that pretty much everyone has positions in is fiat currency, better known as money. The definition of a fiat currency is: state-issued money which is neither legally convertible to any other thing, nor fixed in value in terms of any objective standard. These days most national currencies are fiat currencies including the US dollar, the Euro and the UK Pound, which makes the currency of most countries very vulnerable. Not only would a currency collapse have a devastating effect on the price of goods, it would also cause any positions in an investment vehicle that is only redeemable in a fiat currency, and is not a tradeable commodity (ie. stock market, bond market etc.), to essentially become as valueless as the currency that the investment relies on. The 0nly way to protect one’s self from total devastation in the event of a currency collapse is to have physical positions in a tradeable commodity such as gold. Gold is an asset with inherent value that is also a tradeable commodity. According to an article in Time magazine: “Gold, then, can be considered a currency, unique in that it is not directly tied to any country’s economy. With a global recession that is bound to continue to shake up the purchasing power of all foreign currencies, gold is safer from political and economic instability than cash.”

So where does art fit in to all this?. As we all know, a major financial or economic crisis (or even a little one for that matter) can have a major negative effect on the art market, especially the speculative contemporary art market. Because the perceived investment potential of contemporary art relies heavily on the progression of the artist’s career, which in turn relies on the continued stability of the cultural, social, monetary and economic systems that are currently in place (like the share market), contemporary art is likely to be devalued to a much greater extent in the event of a major economic than the work of the old masters or the impressionists. According to Jim Morris of art and antiques firm Corfield Morris: ‘buyers of contemporary art may be disappointed with returns. He defines contemporary art as works produced by artists who are still alive. “The problem with buying contemporary works is that many of the artists don’t have track records,” said Morris. “I’m afraid an awful lot of it is not going to stand the test of time.”’ Contemporary art is therefore a very risky investment and is not a good store of wealth; contemporary art is essentially the fiat currency of the art world. The work of the Old Masters, the Impressionists and many of the modern masters are, however, a different story. As well as already having a market track record and an already established legacy, the work of the Old Masters, the Impressionists and many of the modern masters have the benefit of having been endowed with some or all of the inherent characteristics that have a quantifiable and qualifiable intrinsic value such as subject matter, style, technical complexity, historical documentation, artistic proficiency, etc. Although some people may disagree that art can have intrinsic value, I believe that the work of certain movements or periods can. Regardless of whether or not you agree that art can have inherent properties of intrinsic value, the fact remains that if the work of the Old Masters did not have intrinsic value, then the art objects would not have any value independent of any and all other factors, which they do. If a work of art in the style of an old master were to be sold as the work of an unknown artist from an unknown period and without any provenance, the art object would still have value even without all other associations and therefore must have intrinsic value. The reason that these inherent properties have a quantifiable and qualifiable value in the case of the work of the Old masters, the Impressionists and many of the modern masters is that there are usually other similar works with which one can make comparisons and judgements and thus determine the value of these inherent properties in relation to another similar work. Particularly in the case of the Old Masters there are often artistic and technical standards that can also assist in the valuation of the inherent physical characteristics of a work.

To be continued…….

What Art Investors Can Learn from Gold Investors Pt. 6 – artmarketblog.com

One of the biggest problems with contemporary art, from a long term investment and wealth preservation perspective, is the seemingly ever decreasing focus on the art object. The focus that was once placed on the art object is being placed more and more on the art concept as well as the increasingly popular notion of the artist as a performer and celebrity. According to a Newsweek article titled Pop Goes the Market, ‘In the era of easy money, artists readily forsook the cliché of the tortured, penniless bohemian, and instead sought fame and fortune by branding their own glamorous, eccentric personas as a tradeable commodity’. Valuing a concept or a performance is almost impossible, especially when there is really no apparent standardisation or continuity from one artist to another. Without the ability to grade or judge the work of one artist with similar work from another artist, determining value becomes even harder. The value we place on what is termed “art” (in a contemporary market context), has less to do with the art object, the tangible result of the artistic process, and more to do with the persona of the artist and their artistic approach. With less emphasis being put on the art object, the value of contemporary art is being based on intangible characteristics and factors that have no perceivable intrinsic value. This means that much of the contemporary art being produced is a speculative and risky investment that would not be suitable as a means of preserving wealth.

One of the biggest problems with contemporary art, from a long term investment and wealth preservation perspective, is the seemingly ever decreasing focus on the art object. The focus that was once placed on the art object is being placed more and more on the art concept as well as the increasingly popular notion of the artist as a performer and celebrity. According to a Newsweek article titled Pop Goes the Market, ‘In the era of easy money, artists readily forsook the cliché of the tortured, penniless bohemian, and instead sought fame and fortune by branding their own glamorous, eccentric personas as a tradeable commodity’. Valuing a concept or a performance is almost impossible, especially when there is really no apparent standardisation or continuity from one artist to another. Without the ability to grade or judge the work of one artist with similar work from another artist, determining value becomes even harder. The value we place on what is termed “art” (in a contemporary market context), has less to do with the art object, the tangible result of the artistic process, and more to do with the persona of the artist and their artistic approach. With less emphasis being put on the art object, the value of contemporary art is being based on intangible characteristics and factors that have no perceivable intrinsic value. This means that much of the contemporary art being produced is a speculative and risky investment that would not be suitable as a means of preserving wealth.

As we all know, the contemporary art market is driven by speculation and a quest for social and cultural superiority that has resulted in, and continues to result in, a plethora of short lived fads. The artists involved in these fads often find themselves suddenly thrust into the art world spotlight by rich and powerful patrons who are more interested in the attention their purchases receive than what they actualloy purchase. Unfortunately, when the next fad comes along, many (if not all) of the artists who were the heroes of the previous fad are subsequently dumped just as quickly as they were found, never to be heard of again. The fact that very few contemporary artists survive long enough to preserve their place in the annals of art history makes investing in any contemporary artist a risky business and therefore not a safe means of accumulating wealth or a good means of preserving wealth.

The works of art that are most suitable for long term investment and wealth preservation are those works that have the potential to be used as a tradeable commodity. As I wrote in a previous post, fine art has been proven to be able to act as a tradeable commodity by criminals, who are known to use fine art as collateral for drug and gun deals. According to Dick Ellis, the former head of Scotland Yard’s Art and Antiques Squad and an expert on art crime, “thieves get nowhere near full value, usually only 10 to 12 percent. But even if a thief trades a multi-million dollar Picasso for, say, $500,000-worth of AK 47′s, he still comes out okay. Regional wars involving old tribes, new gangs have made it worst says Julian Radcliffe, citing the Balkan War of the 1990′s. Ellis then goes on to say that “art is often held as security at an arms deal. Then, once the guns are paid for, the art is gradually sold back to Western Europe through shady dealers or art fares”.

One of the most important characteristics of a tradeable commodity is standardisation. Gold is an excellent example of a tradeable commodity because of the fact that it is an extremely standardised good which makes it very easy to trade. One particular luxury good that has been the focus of much speculation due to differing opinions regarding the good’s status as a tradeable commodity is the diamond. Martin Rapaport, a highly regarded diamond dealer and advocate for the commoditisation of diamonds, says that diamonds are definitely a commodity because: “You buy and sell them for cash. They’re a natural resource with limited supply; they’re well defined; they’re certified; they’re analyzed, graded, tradable around the world”. The only artists whose work can be considered have the characteristics that Rapaport identifies, ie. are in: limited supply; well defined; certified; analyzed; graded, and tradeable around the world, are the Old Masters and some artists from more modern movements such as impressionism which still retain many of the characteristics of the movements associated with the Old Masters. The work of the Old Masters are also relatively standardised and are therefore the most likely candidates for being used as a tradeable commodity should an global economic collapse take place. My advice, therefore, is to have at least some positions in the work of Old Masters as a form of wealth preservation and a hedge against the likely economic collapse that is soon to take place.

What Art Investors Can Learn from Gold Investors: The Conclusion

People who speculate on contemporary art are essentially betting that the artistic, social, cultural and economic framework which gave birth to the work of the artist whom they speculated on will continue to develop and progress. The problem is that the chances of that framework completely disintegrating are becoming increasingly higher as the likelihood of a global economic crisis increases. Since the future development and continuation of the public and private organisations that nurture and patronise contemporary artists need financial support just like any other organisation, a major economic collapse could spell disaster for these institutions as well as the artists that they were, or were going to, help nurture.

Regardless of what happens to the global economy, there will always be people who are better off than others and can afford more luxuries such as art. There will, therefore, always be a market for art even during a global economic crisis – albeit a very different and highly selective market. If your game is wealth preservation, and especially if you believe in the soon to eventuate economic apocalypse, you should be asking yourself the question: “Would there be a demand, and how great would that demand be, for the fine art I have in my collection if a global financial crisis took place which completely destroyed the art market and cultural framework of society as we know it?. The answer you give will depend on whether you have the sort of art whose value is dependant almost entirely on the artistic, social, cultural and economic framework of contemporary society, or whether you own art which has characteristics (for more information read above thesis) that will have value regardless of the context in which they are valued.

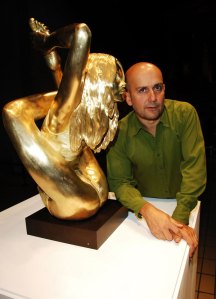

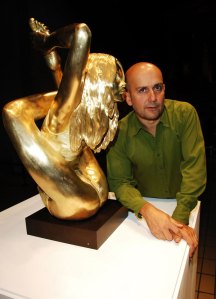

If you want a fool proof and financial apocalypse proof investment that gives you the benefits of owning art and gold then get a 24 karat gold statue made for youself !!!

I will leave you with these words from the Fine Art Wealth Management website:

‘Art like gold, is an irreplaceable, unleveraged real assset which is why many investors turn to as a safe haven in times of economic uncertainty. Since the turn of the millenium we have seen the AMR Art 100 Index perform in a similiar manner to gold. Historically, both art and gold have shown similiar characteristics and performance, especially over the last decade. Art like gold provides a historically proven vehicle for hedging against inflation.'(http://www.fineartwealthmgt.com)

**Nicholas Forrest is an art market analyst, art critic and journalist based in Sydney, Australia. He is the founder of http://www.artmarketblog.com, writes the art column for the magazine Antiques and Collectibles for Pleasure and Profit and contributes to many other publications

**Nicholas Forrest is an art market analyst, art critic and journalist based in Sydney, Australia. He is the founder of http://www.artmarketblog.com, writes the art column for the magazine Antiques and Collectibles for Pleasure and Profit and contributes to many other publications

Filed under: art, art investment, art market, gold, gold investment, gold market | Tagged: art, art investment, art market, artist, gold, gold investment, wealth preservation | 4 Comments »

Yes, art is definitely a long term investment. In fact, art is really only a good investment if it is able to be held for long periods of time. As an indication of how long an investment in fine art should be held, most fine art funds require a ten year commitment – the same length of time that I would recommend anyone investing in art should be prepared to hold on to their investment for. Although it is quite old, a study completed in 1985 by Michael F. Bryan on behalf of the Federal Reserve Bank of Cleveland titled ‘Beauty and the Bulls: The Investment Characteristics of Paintings’ provides a good insight into the characteristics of the art market. According to Bryan: ‘Over the 15-year period (1970-1984), the rate of appreciation in paintings typically outpaced the rate of increase in the general price index (consumer price index). However, within short intervals (1973-1977and 1980-1982), painting’s price appreciation did not keep pace with inflation. During one year of inflationary pressure (1980-1981) paintings actually depreciated in value. In short, while the rate of appreciation in paintings is positively related to the general price level, and moreover has outpaced inflation over the full period of analysis, its year-to-year performance has been considerably volatile.’

Yes, art is definitely a long term investment. In fact, art is really only a good investment if it is able to be held for long periods of time. As an indication of how long an investment in fine art should be held, most fine art funds require a ten year commitment – the same length of time that I would recommend anyone investing in art should be prepared to hold on to their investment for. Although it is quite old, a study completed in 1985 by Michael F. Bryan on behalf of the Federal Reserve Bank of Cleveland titled ‘Beauty and the Bulls: The Investment Characteristics of Paintings’ provides a good insight into the characteristics of the art market. According to Bryan: ‘Over the 15-year period (1970-1984), the rate of appreciation in paintings typically outpaced the rate of increase in the general price index (consumer price index). However, within short intervals (1973-1977and 1980-1982), painting’s price appreciation did not keep pace with inflation. During one year of inflationary pressure (1980-1981) paintings actually depreciated in value. In short, while the rate of appreciation in paintings is positively related to the general price level, and moreover has outpaced inflation over the full period of analysis, its year-to-year performance has been considerably volatile.’ **Nicholas Forrest is an art market analyst, art critic and journalist based in Sydney, Australia. He is the founder of http://www.artmarketblog.com, writes the art column for the magazine Antiques and Collectibles for Pleasure and Profit and contributes to many other publications

**Nicholas Forrest is an art market analyst, art critic and journalist based in Sydney, Australia. He is the founder of http://www.artmarketblog.com, writes the art column for the magazine Antiques and Collectibles for Pleasure and Profit and contributes to many other publications