The 2010 Art Market Review – artmarkeblog.com

2010 has been one of the most confusing, unpredictable and unexplainable years for me as an art market analyst. So many of the trends, events and fads that emerged during 2010 did not appear to be caused by the sort of conditions, have the same effects, or follow the same path of logic that one would expect they would given the way things have panned out in past years. This leaves me with no doubt that the art market is evolving at such a rapid pace that there is little point trying to justify or explain the events of today using logic that is based on the progression and events of previous years. In fact, more of the art market events that took place during 2010 appeared to defy logic than ever before. I do, however, strongly believe that one of the reasons that it has become even more difficult to determine what is going on with the art market is that the art market (auction houses in particular) has become adept at making the situation appear much better than it really is. Whether it be by skewing figures or manipulating the way results are perceived – galleries, fairs and auction houses have become the plastic surgeons of the art world.

2010 has been one of the most confusing, unpredictable and unexplainable years for me as an art market analyst. So many of the trends, events and fads that emerged during 2010 did not appear to be caused by the sort of conditions, have the same effects, or follow the same path of logic that one would expect they would given the way things have panned out in past years. This leaves me with no doubt that the art market is evolving at such a rapid pace that there is little point trying to justify or explain the events of today using logic that is based on the progression and events of previous years. In fact, more of the art market events that took place during 2010 appeared to defy logic than ever before. I do, however, strongly believe that one of the reasons that it has become even more difficult to determine what is going on with the art market is that the art market (auction houses in particular) has become adept at making the situation appear much better than it really is. Whether it be by skewing figures or manipulating the way results are perceived – galleries, fairs and auction houses have become the plastic surgeons of the art world.

What has also made 2010 such a hard year to analyse was the contraction, and slow regeneration, of the market for the work of trendy emerging artists and recent works by top contemporary artists – both of which are usually the most global, visible and publicised sectors of the market. As the market moves towards the work of artists with a proven track record, collectors and investors have shifted their focus from the usually dominant and globally relevant contemporary art market to the work of artists from a wide of variety of styles, mediums and movements that cannot appear to have very little in common. This has resulted in a situation where there is not one dominant global trend that art market analysts such as myself can focus on, but a number of smaller and disjointed trends that make reading the market particularly difficult.

A few months ago I wrote a series of posts on what I believed was a move towards a more sentimental art market, which appears to be exactly the direction that the market has headed. General disillusionment with the contemporary art market has sent many collectors and investors take a more sentimental approach to fine art that is characterised by a focus on the safety of more established artists and the familiarity of artists that they can relate to. When art collectors or investors seek safety and familiarity they are most likely to gravitate towards works by artists from the era and culture that they have the greatest connection to. This would explain the large number of seemingly unrelated trends that emerged during 2010 many of which involved previously unfashionable styles and movements that are distinctly associated with a particular era or culture.

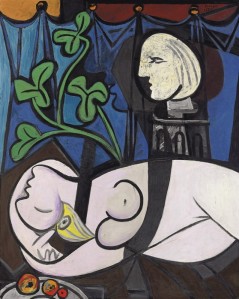

There is no doubt that the art market has recovered far quicker than many people thought possible. Again, the unexpectedly rapid recovery has thrown a spanner in the works when it comes to analysing the art market and trying to make sense of what is going on. Some journalists and analysts have gone as far as to admit that they cannot explain how a market that seemed to be at breaking point could make such a rapid recovery. To give you an idea of how quickly the art market has recovered, in March of this year (2010) Walter Robinson, editor of Artnet Magazine, said that “Art Market Watch has been on something of a hiatus during the last few months. What with the recession, reporting on auction results just isn’t as compelling as it was during the boom years”. Six weeks later a painting by Picasso become the most expensive work of art ever sold at auction when it fetched a staggering $106.5 million. A week after that an Andy Warhol self portrait sold at Sotheby’s for $32.6 million (more than twice the estimate) setting a new record for a Warhol self portrait at auction. Compelling enough?

When it comes to rationalising art market events there is much to be gained from knowing who has money to spend and how much they have to spend. The top end of the market is fuelled by super wealthy collectors whose level of wealth would not have been affected enough by the financial crisis to deter them from buying art. Therefore at the high end of the art market things have been pretty solid as is evident from the number of record auction prices set in 2010. The lower end of the market is fuelled by collectors who focus on edgy and trendy contemporary art by emerging and newly established artists, and who will usually have a high level of interest in the cultural and artistic side of fine art. Collectors at the lower end of the market are a very determined group who are always going to be around even if they appear a little less active at times. Things at the lower end have improved but have done so at a less than rapid pace which makes it difficult to judge where this sector of the market is heading. Without a doubt the sector of the art market that has suffered for the longest period of time due to the effects of the global financial crisis and the art market downturn is the middle market. The middle market includes lesser works by big name artists, and the more expensive (less justifiable) works by the trendy contemporary artists, which makes the middle market a sort of currently un-necessary compromise for the super rich, and a stretch too far for the modestly well off. Middle market works are, however, perfect for the financial advisor and hedge fund manager types who are more interested in art as a status symbol than the quality or art historical importance of the works they are buying. With the pay packets of hedge fund managers and financial advisors taking a massive hit due to the financial crisis, there is little interest in the middle market works. The super rich are still rich enough to not have to compromise and settle for middle market works and the modestly well off continue to fuel the lower end of the market.

My next post will be the top ten art market 2010 so stay tuned……..

**Nicholas Forrest is an art market analyst, art critic and journalist based in Sydney, Australia. He is the founder of http://www.artmarketblog.com, writes the art column for the magazine Antiques and Collectibles for Pleasure and Profit and contributes to many other publications

**Nicholas Forrest is an art market analyst, art critic and journalist based in Sydney, Australia. He is the founder of http://www.artmarketblog.com, writes the art column for the magazine Antiques and Collectibles for Pleasure and Profit and contributes to many other publications

Filed under: art investment, art market, art market news, art market review, art news, art sales, art trends, fine art | Tagged: art investment, art market, art news, art trends, artist, fine art | 8 Comments »

At Sotheby’s Impressionist & Modern Art Evening Sale held on the 22nd of June, the top price paid was again for a portrait. Edouard Manet’s ‘Portrait de Manet par lui-même, en buste (Manet à la palette)’ fetched £22,441,250 against an estimate of £20,000,000-30,000,000 – a record for the artist at auction. The top-selling lot of the June Russian Paintings Day Sale was Boris Grigoriev’s oil on canvas Portrait of the artist’s son, Kirill, which sold for the sum of £253,250, above its high estimate of £200,000. Another portrait, Alexander Evgenievich Yakovlev’s ‘Titi and Naranghe, Daughters of Chief Eki Bondo’, took top spot at the 7 June Important Russian Art Sale selling for £2,505,250 – more than triple the £700,000 – 900,000 estimate . Sotheby’s sale of the long-lost art trove of Ambroise Vollard saw more records set for works on paper held in Paris on the 29th of June. According to the Sotheby’s press release from the sale: “Key works among the highlights of the group were an extremely fine impression of Picasso’s celebrated 1904 etching ‘Le Repas frugal’ (another portrait), which more than doubled its high estimate of €300,000 to bring €720,750 (£584,078), the highest price of the sale. A monotype by Edgar Degas, ‘La Fête de la patronne’, circa 1878-79 soared past pre-sale estimates (€200,000-300,000) to bring €516,750. Paul Gauguin’s ‘Trois Têtes Tahitiennes ‘sold for €312,750 (£253,445) well above the estimate of €100,000 to €150,000 and a record was set for a print by Pierre-Auguste Renoir when ‘Le Chapeau Epinglé, Deuxième Planche’ more than tripled its high estimate of €80,000 to bring €252,750 (£204,822). Man Ray’s ‘Autoportrait solarié’ fetched €168,750 ($206,138)”

At Sotheby’s Impressionist & Modern Art Evening Sale held on the 22nd of June, the top price paid was again for a portrait. Edouard Manet’s ‘Portrait de Manet par lui-même, en buste (Manet à la palette)’ fetched £22,441,250 against an estimate of £20,000,000-30,000,000 – a record for the artist at auction. The top-selling lot of the June Russian Paintings Day Sale was Boris Grigoriev’s oil on canvas Portrait of the artist’s son, Kirill, which sold for the sum of £253,250, above its high estimate of £200,000. Another portrait, Alexander Evgenievich Yakovlev’s ‘Titi and Naranghe, Daughters of Chief Eki Bondo’, took top spot at the 7 June Important Russian Art Sale selling for £2,505,250 – more than triple the £700,000 – 900,000 estimate . Sotheby’s sale of the long-lost art trove of Ambroise Vollard saw more records set for works on paper held in Paris on the 29th of June. According to the Sotheby’s press release from the sale: “Key works among the highlights of the group were an extremely fine impression of Picasso’s celebrated 1904 etching ‘Le Repas frugal’ (another portrait), which more than doubled its high estimate of €300,000 to bring €720,750 (£584,078), the highest price of the sale. A monotype by Edgar Degas, ‘La Fête de la patronne’, circa 1878-79 soared past pre-sale estimates (€200,000-300,000) to bring €516,750. Paul Gauguin’s ‘Trois Têtes Tahitiennes ‘sold for €312,750 (£253,445) well above the estimate of €100,000 to €150,000 and a record was set for a print by Pierre-Auguste Renoir when ‘Le Chapeau Epinglé, Deuxième Planche’ more than tripled its high estimate of €80,000 to bring €252,750 (£204,822). Man Ray’s ‘Autoportrait solarié’ fetched €168,750 ($206,138)”